When you formalised your mortgage, several abusive terms were included in your deed. These terms obliged you to pay a series of expenses such as notary fees, property registration office fees, an origination fee...

However, it must be the bank itself the one assuming those expenses, not the customer.

We will help you to get back that money claiming those expenses to Unicaja.

Unicaja is one of the main banks in Andalusia, although it has offices all over Spain.

After its merger with EspañaDuero (formerly Caja Spain and Caja Duero), the Unicaja group must also answer for the claims of the former clients of those entities, especially floor clause and mortgage expenses claim.

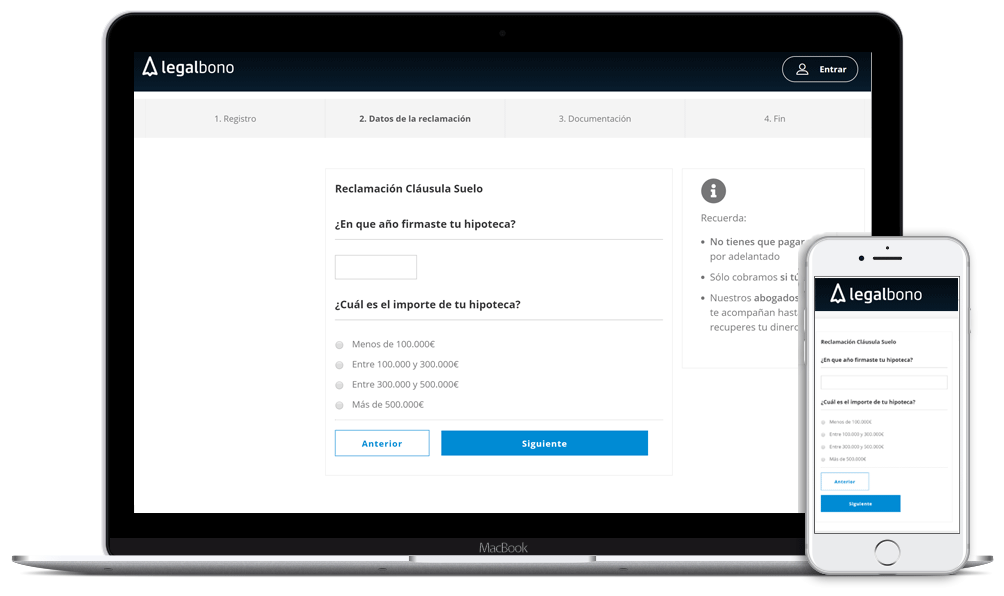

Starting your claim to Unicaja is very easy. You can fill out the form from your computer or smartphone at any time. You just have to:

1. Answer some simple questions.

2. Scan and send us the requested documentation.

3. A legal expert will contact you to let you know how much money you can claim back.